How to Understand Property Taxes, Society Fees & Closing Costs in 2026

Table of Contents

By Panchmukhi Infra Rescon Pvt Ltd

Buying a home is one of the biggest financial milestones in life, but the price tag on the listing is rarely the final number you pay. To truly afford your dream home in Dehradun or anywhere in India, you must look beyond the home loan EMI and understand the “hidden” trinity of homeownership costs: Property Taxes, Society Maintenance (HOA) fees, and closing costs.

Did you know that Indian homeowners collectively pay thousands of crores in municipal taxes annually? As we step into 2026, the real estate market is booming, but many first-time buyers are still shocked when their first bill arrives.

At Panchmukhi Infra Rescon Pvt Ltd, we believe in transparent real estate education. In this guide, we will break down these costs, explain how to calculate property taxes, and share smart budgeting tips so you can buy with confidence.

What Are Property Taxes and How Do They Work?

To master your budget, you first need a clear property tax definition. Simply put, property taxes are recurring fees paid by homeowners to local municipal bodies (like the Nagar Nigam in Dehradun). These funds are the lifeblood of your community, paying for essential services like street lights, drainage, road maintenance, and waste management.

Key Factors That Set Your Tax Rate

Property tax rates depend largely on where you live. In 2026, many Indian cities are upgrading their assessment systems.

- Location: A home in a posh sector of Dehradun or a metro like Mumbai will have higher assessments than a property on the outskirts.

- Assessed Property Value: In India, this is often calculated using the “Unit Area Method,” which considers the built-up area, usage (residential vs. commercial), and age of the building.

- Millage Rate Property Tax: While the term “millage rate” is common in global markets (representing $1 tax per $1,000 value), in India, we use a percentage of the assessed property value or a per-square-foot rate fixed by the municipality.

Real-World Calculation Example

Understanding how to calculate property taxes is easier than it looks. Let’s look at a case study of a ₹60 Lakh (60,00,000 INR) apartment in Dehradun.

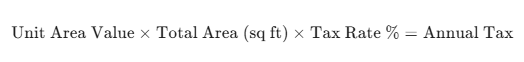

The Formula (Simplified):

- Property Value/Area: 1,500 sq ft

- Rate: Approx. ₹2.50 per sq ft (Hypothetical rate for 2026)

- Annual Bill: Approx. ₹4,000 – ₹8,000 (depending on municipal slabs).

Ways Taxes Change Over Time

Property taxes are not fixed.

- Reassessments: If you add a floor or renovate, the property tax assessor may increase your bill.

- Delinquent Property Taxes: Failing to pay property taxes by the property tax due date (usually March 31st) can lead to penalties of 1–2% interest per month.

- Appeals: If you believe your bill is wrong, you can file a property tax appeal (or property tax protest) with the municipal commissioner to try and lower property taxes.

Society Maintenance (HOA) Fees Explained

In India, “HOA” is commonly known as the Resident Welfare Association (RWA) or Society Maintenance.

Common Fee Breakdown

Where does that money go?

- Maintenance (40%): Security guards, housekeeping, lift maintenance.

- Amenities (30%): Swimming pools, clubhouses, gyms.

- Reserves (20%): Sinking fund for major future repairs (painting, structural fixes).

Stat: In 2026, the average maintenance charge in Grade A societies in cities like Dehradun ranges from ₹2.5 to ₹5 per sq ft.

Pros, Cons, and Hidden Fees

- Pros: You don’t have to worry about water supply or security yourself.

- Cons: Fees can rise. If the society needs a new generator, a “Special Assessment” could hit you with a sudden ₹50,000 demand.

How to Pick Low-Cost Societies

- Review the Books: Ask the RWA for last year’s expense report.

- Check the Sinking Fund: Is there enough cash for emergencies?

- Cap Your Budget: Ensure monthly maintenance doesn’t exceed 10-15% of your expected rental yield.

Closing Costs Demystified: Stamp Duty & Registration

Closing costs in India are primarily Stamp Duty and Registration charges. These are mandatory to legally transfer the title to your name.

Government Fees (The Big Hit)

- Stamp Duty: This varies by state. In Uttarakhand, it is roughly 5% (often lower for female buyers).

- Registration Fee: Typically 1% of the property value or a fixed cap (e.g., max ₹30,000 in some states).

Stat: For a ₹50 Lakh home, closing costs can easily reach ₹3.5 Lakhs.

Third-Party and Prepaid Costs

- Legal/Advocate Fee: ₹15,000 – ₹25,000 for title search.

- Brokerage: 1% – 2% of the deal value.

- Prepaids: You may need to pay advance maintenance or property taxes for the remaining financial year.

Timeline and Negotiation Tips

- Timeline: Expect 30–45 days from booking to registry.

- Actionable: Ask your developer if they are running any “Stamp Duty Waiver” offers—a common promotion in 2026.

Budgeting for All Three: Total Ownership Costs

| Expense Category | Estimated Annual Cost (INR) | Monthly Impact |

| Home Loan EMI | ₹8,50,000 | ₹70,800 |

| Property Taxes | ₹12,000 | ₹1,000 |

| Society Maintenance | ₹60,000 | ₹5,000 |

| Insurance | ₹10,000 | ₹833 |

| Total | ₹9,32,000 | ₹77,633 |

- Section 80C: You can claim a property tax deduction (specifically stamp duty and registration charges) up to ₹1.5 Lakh in the year of purchase.

- Section 24(b): Deduction on home loan interest payments.

- Senior Property Tax Exemption: Some Indian municipalities offer a property tax reduction (rebate) for senior citizens or women owners.

Conclusion

Understanding the financial landscape is the key to successful homeownership. Property taxes fund the basics of your city, Society fees maintain your lifestyle, and closing costs seal the legal deal.

By doing your homework—checking the local tax rates, reviewing RWA docs, and calculating stamp duty—you can save lakhs. Whether you are looking for residential property taxes info or commercial property taxes advice, being informed is your best asset.

Property taxes don’t have to be a confusing burden. With the right knowledge, they are just another managed expense in your portfolio.

Ready to find your dream home in Dehradun?

Next Step: Download our 2026 Homebuyer’s Cost Checklist or visit the Panchmukhi Infra Rescon Pvt Ltd office on Sahastradhara Road to discuss your investment today. Let us help you turn these costs into a smart buy!

Contact Us | Book Your Project

How to Understand Property Taxes, Society Fees & Closing Costs in 2026

How to Understand Property Taxes, Society Fees & Closing Costs in 2026 Table of Contents By